s corp dividend tax calculator

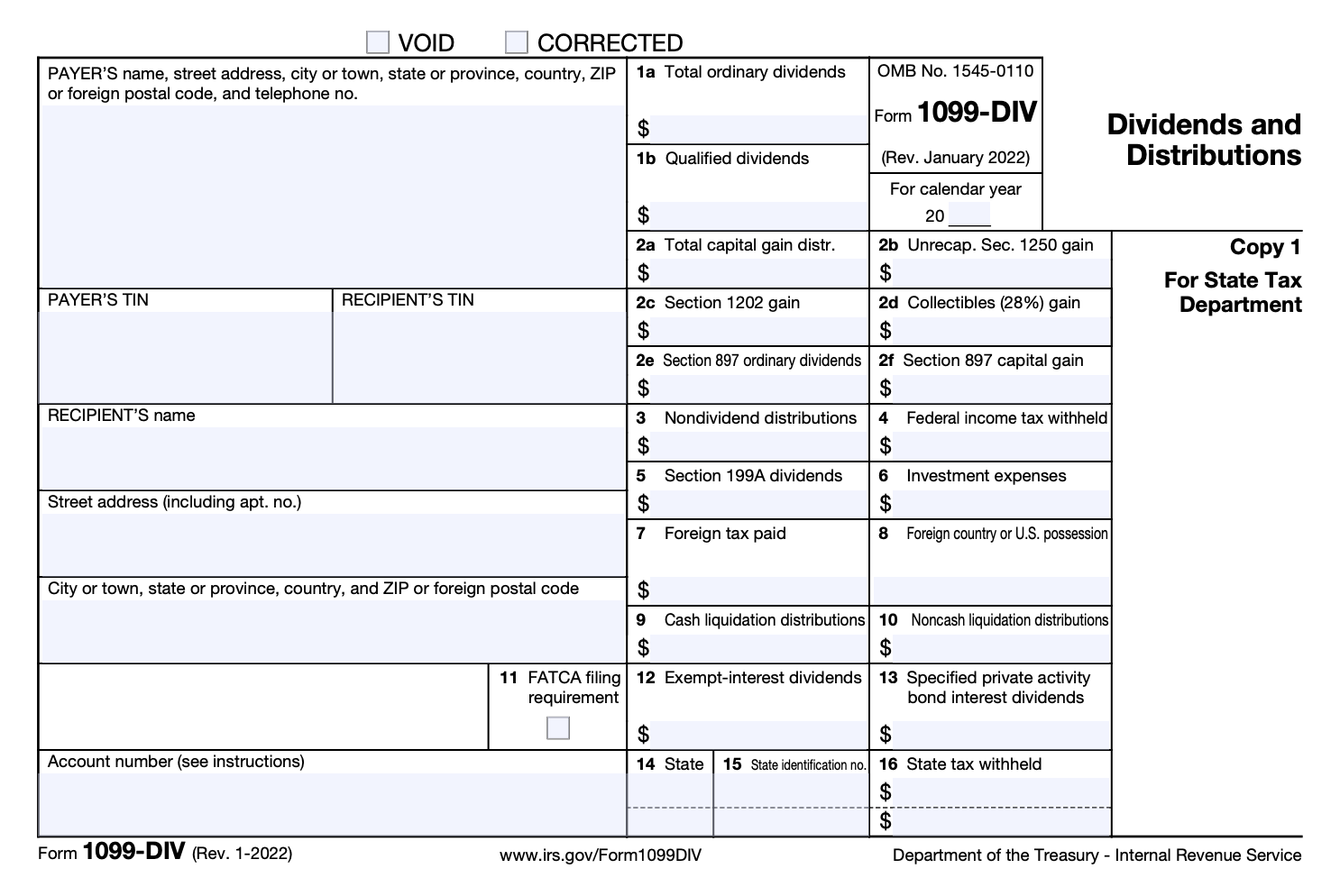

S corp qualified dividends usually refer to the dividends paid out of earnings accumulated during the tax years when an S corporation operated as a C corporation. There is a big.

How An S Corporation Reduces Fica Self Employment Taxes

Im an additional rate taxpayer what do I pay.

. Property Tax Calculator. Dividends are paid by C corporations after net income is calculated and taxed. 875 of Dividend Income for income within the Basic Rate band of 20 3375 of Dividend Income for income within the.

The leftover funds are distributed as. S corp dividend tax calculator Tuesday March 1 2022 Edit. Say for example that you get 125000 of income from an S corporation.

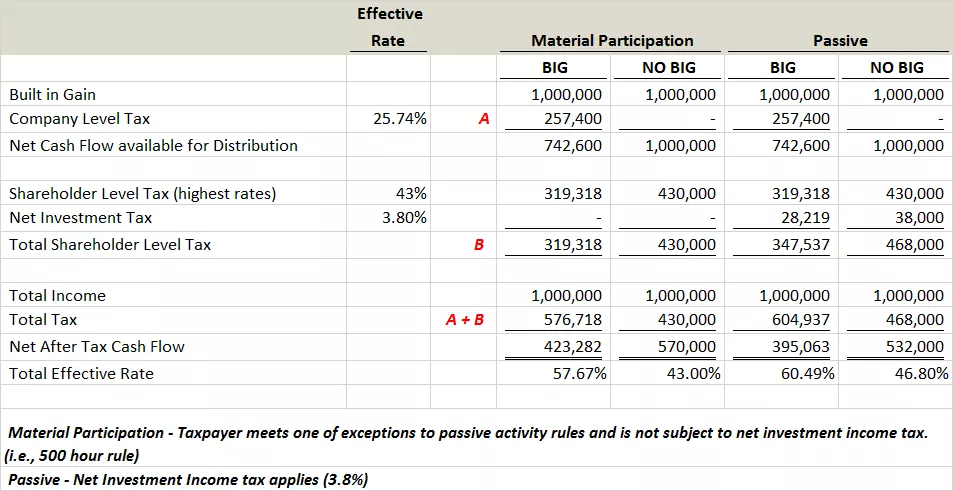

But if the income is long-term capital gains or qualified dividends you pay the lower preferential tax rates sometimes. Now for reference lets compare the the qualified dividend tax rates for 2021. 875 basic 3375 higher and 3935 additional.

What percent of equity do you own. If the income is ordinary income you pay the ordinary income tax rates. There is a lot of misconception on how to pay yourself that Reasonable Compensation when your company is an S-Corp.

The new dividend tax rates for 202223 tax year factoring in the 125 point rise are. S-Corp Reasonable Compensation ins and outs. See the table below.

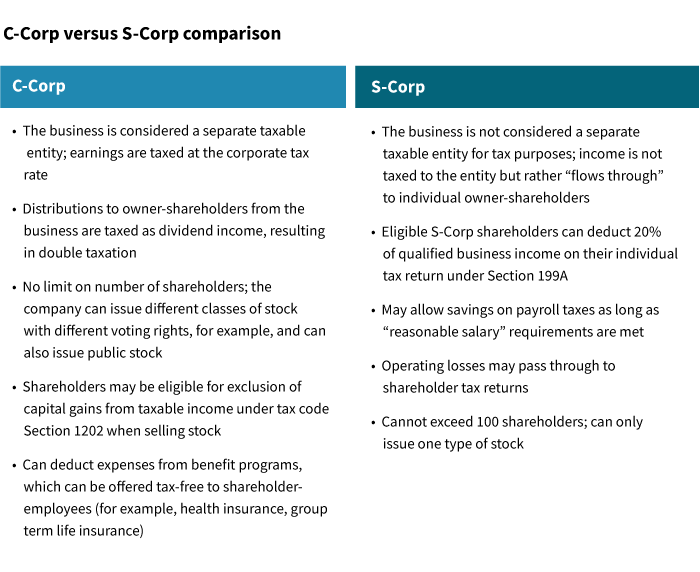

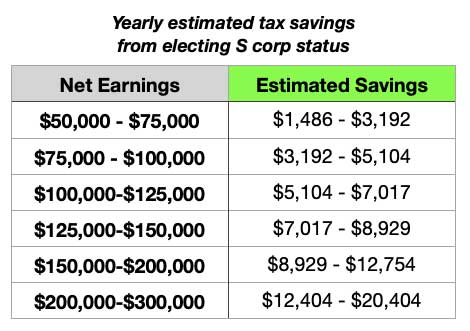

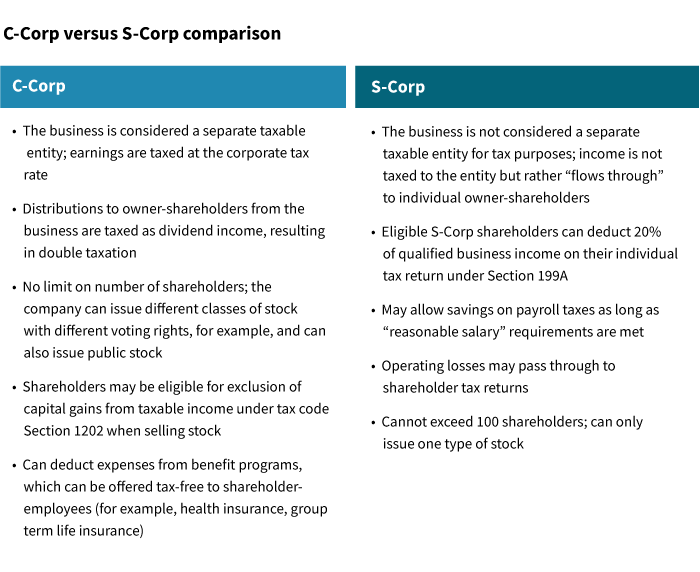

After electing S corp status an LLC owner uses profits to pay salaries and distributions to owner-employees. S Corporation Distributions. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business.

For example if you pay out 50000 in distributions and person A owns 50 percent of the S Corporation person B owns 30 percent and person C owns 20 percent. The SE tax rate for business owners is 153 tax. The business must make at least 60000.

2022-02-23 As a pass-through entity S corporations distribute their earnings through the payment of dividends to shareholders which are only. Profit and Distribution. Dividend Tax Rates for the 2021 Tax Year.

With the use of our Dividend Tax Calculator you are able to discover how much income tax you will be paying with the input of your current salary and the annual dividend payments that you. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. If income is standard income you would pay the standard income tax rates.

Person A would receive. An S corporation is not subject to corporate tax. For example if your one-person S corporation makes 200000 in profit and a.

If you earn over 150000 or more across all sources of income you pay 3935 tax on the dividends you earn over 2000 per tax year. This may potentially reduce. If an S corp allocates 125000 profit to you the shareholder the character of such income is important.

Here S How Much You Ll Save In Taxes With An S Corp Hint It S A Lot

%20Image%20(GD-665).png)

Small Business Tax Calculator Taxfyle

How To Pay Yourself From Your S Corp What Is A Reasonable Salary The Hell Yeah Group

Reporting C Corporation Dividends To Shareholders Smartasset

What Is A Pass Through Business How Is It Taxed Tax Foundation

Should You Choose S Corp Tax Status For Your Llc Smartasset

Calculate S Corp Taxes Using An S Corp Calculator Youtube

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

S Corp Tax Secrets Tax Savings Strategies 2023 White Coat Investor

Corporate Tax In The United States Wikipedia

Distributions From S Corps Can Fund Life Insurance Premiums Bsmg Brokers Service Marketing Group

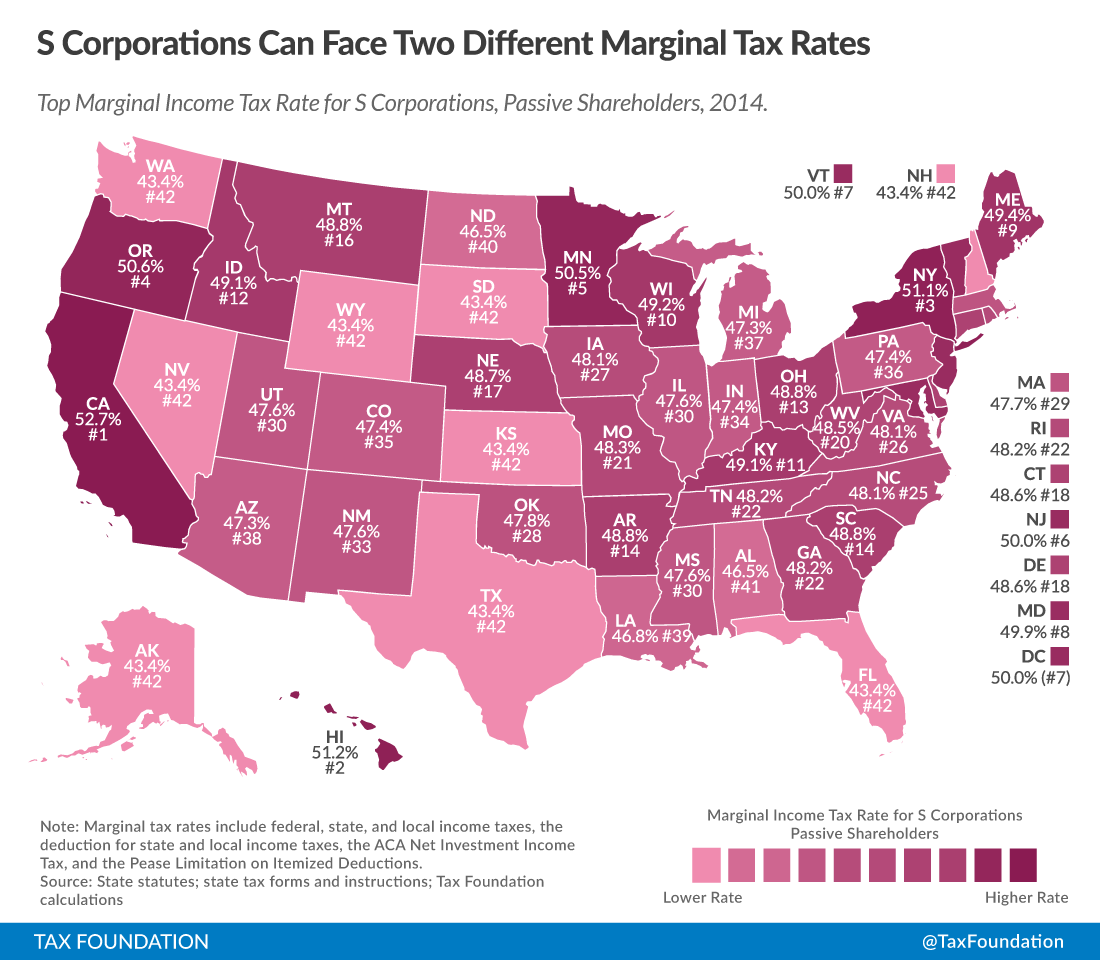

The Dual Tax Burden Of S Corporations Tax Foundation

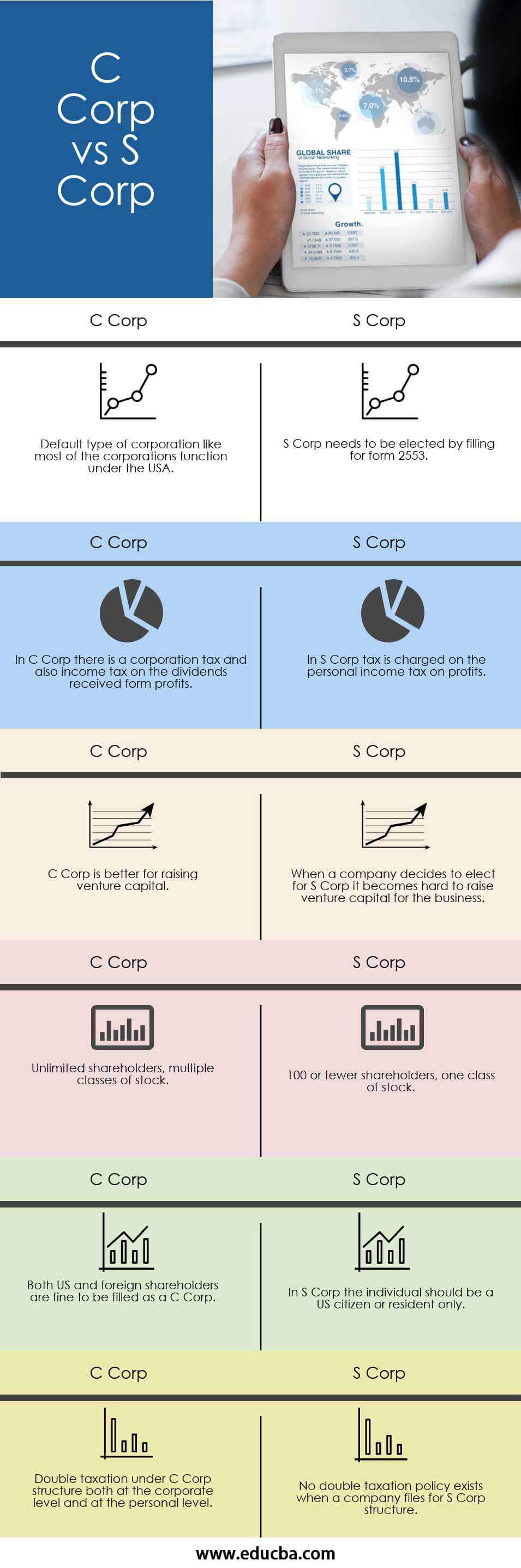

C Corp Vs S Corp Top 6 Best Differences With Infographics

The Basics Of S Corporation Stock Basis

Should You Choose S Corp Tax Status For Your Llc Smartasset

Taxation In An S Corporation Distributions Vs Owner S Compensation Youtube

Discover How Incorporating An Llc Can Save Money On Taxes

S Corporation Tax Filing Benefits Deadlines And How To Bench Accounting

Proposed Tax Hike May Drive Shift In Business Structure Putnam Investments